Is Delaware corporate legislation applicable? Relevance is a relational principle. Relevant to what? Rules of corporate regulation are deemed in efficiency’s gentle. Successful legal guidelines ought to enrich business price. Is Delaware law extra productive than the guidelines of other states these that we should really see a “Delaware premium”? Do inter-point out variations in corporate regulation make any difference?

The strategy of a “race” for top quality has commanded the interest of scholars since the Cary–Winter discussion. It is central to the query of federalism in company legislation. The advocates of Delaware legislation acknowledge the watch that it signifies the solution of a race to the prime. But suppose the “race” is a figment of our theoretical creativity. Suppose there is no proof of a Delaware valuation premium. If so, under the commonly approved evaluate of top quality (efficiency and agency price), company legislation would be irrelevant. A considerably scaled-down camp in the academic debate has argued that corporate legislation is “trivial.” In The Irrelevance of Delaware Company Law, 48 J. Corp. L. (forthcoming 2022), I deliver empirical help for the hypothesis that, inspite of the law’s purported aspiration for effectiveness, inter-point out discrepancies in point out corporate legislation have no foundation in performance.

I present two sets of empirical info exhibiting no empirical evidence of an actionable Delaware quality or edge in company worth. The to start with set of details is a 5-year study of valuations. It analyzes the current market values and stock prices of general public Fortune 500 firms in excess of the period 2015–2019. About just one-third of general public Fortune 500 providers are chartered in other states, like some of the premier, most critical organizations in The us. This article demonstrates that there is no Delaware premium. The 2nd established of empirical information is fewer traditionally considered of as “empirical,” but the evidence is every single little bit that and crucial. It is observations of current market habits. Market actors behave in a way that presumes the irrelevance of Delaware regulation and inter-state variances in condition corporate law. The two sets of empirical knowledge are similarly important, and both of those are mutually reinforcing.

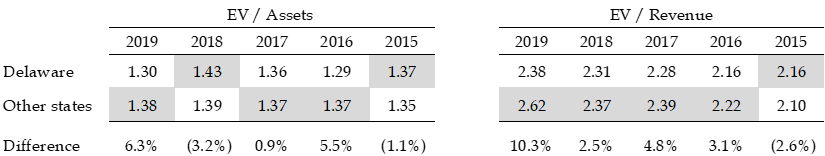

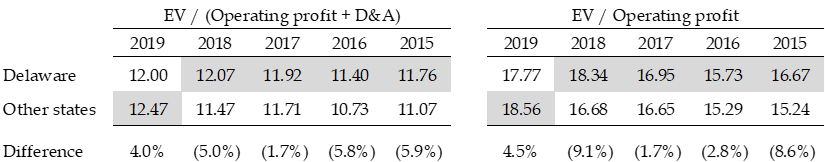

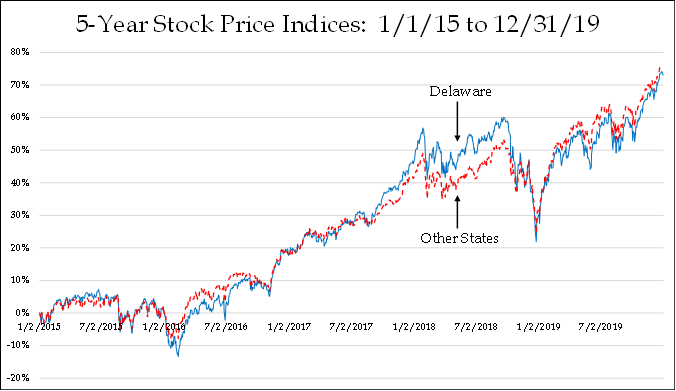

After sorting for state-chartered firms with total money info and stock charges for the five-year period of time 2015–2019, two portfolios had been designed for the ensuing 413 community providers: Delaware and non-Delaware firms. Valuations were being measured employing six distinctive market multiples (EV/Assets, EV/Profits, EV/operating financial gain, EV/EBITDA, P/E, P/B). Using various actions is a greatest observe of economic analysts, and is a far better way of carrying out valuations than simply relying on a single measure, which has been the process of past studies relying only on Tobin’s Q. Also, inventory rate indices ended up established for Delaware organizations and non-Delaware businesses, and stock charges ended up tracked around the 5-yr interval.

Raw calculations are pretty much by no means useful in valuation scientific tests mainly because invariably there are outlier details that disproportionately have an affect on the mixture results. A few sets of screening were conducts. All guidelines had been used uniformly to the whole information set. The adhering to are the multiples for the 6 valuation actions in between Delaware and non-Delaware companies in excess of five yrs. This set of data screened out serious values and negative multiples. Increased values are shaded in gray.

The average variance among the the six multiples throughout 5 years is unfavorable (.5{e421c4d081ed1e1efd2d9b9e397159b409f6f1af1639f2363bfecd2822ec732a}) for all non-Delaware firms. An examination of all sets of multiples in the short article exhibits no actionable Delaware top quality.

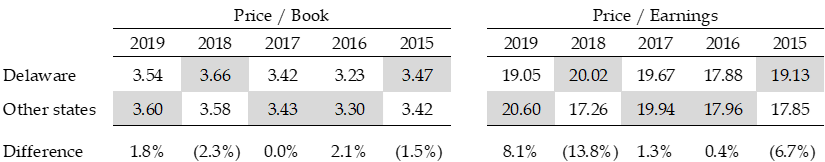

A stock rate examination was also executed. Indices of Delaware and non-Delaware providers have been established. The next chart tracks the 5-yr inventory selling price motion for the period January 1, 2015, to December 31, 2019. The strong line (――) is the Delaware index and the dashed line (– – –) the non-Delaware index.

The correlation coefficient among the two portfolios was substantial (.9857), which is predicted given the quantity of businesses in the indices, the diversification of the industries represented therein, and the relative sizing of the providers. Full returns and annualized costs of return for the five-12 months time period had been: (1) non-Delaware 75.08{e421c4d081ed1e1efd2d9b9e397159b409f6f1af1639f2363bfecd2822ec732a} and 11.85{e421c4d081ed1e1efd2d9b9e397159b409f6f1af1639f2363bfecd2822ec732a} (2) Delaware 73.01{e421c4d081ed1e1efd2d9b9e397159b409f6f1af1639f2363bfecd2822ec732a} and 11.59{e421c4d081ed1e1efd2d9b9e397159b409f6f1af1639f2363bfecd2822ec732a}.

Based on a entire evaluate of valuations and stock selling price general performance as introduced in my paper, Delaware organizations did not display a discernable top quality to benefit or exceptional inventory price tag overall performance.

The actuality that there is no Delaware premium is constant with evidence of market actions. Current market actors ordinarily act or report on value indicators: e.g., organizations, shareholders, activist shareholders, lawyers, investment bankers, hedge cash and traders, safety analysts, Delaware courts, financial expert witnesses, and trade publications and textbooks. If there was an actionable Delaware high quality, market place actors would undoubtedly have acted upon that value differential. They are not behaving as however Delaware legislation issues, and the silence is akin to the Holmesian pet.

- Non-Delaware corporations, some of which are the premier, essential corporations in The us, are not speeding to reincorporate in Delaware.

- Shareholder activism is not based mostly on a tactic of reincorporation to Delaware as a kind of extracting price.

- No shareholder proposal of non-Delaware firms analyzed in this article in the several years 2015–2019, a overall of 660 shareholder proxy statements, proposed reincorporation to Delaware.

- Traders are not executing a “Delaware trade” in which discrepancies in law signify an arbitrage chance.

- Expense bankers do not consider inter-state variations in corporate regulation when they provide fairness or valuation thoughts, and this kind of discussions are not viewed in merger proxies or registration statements.

- Safety analysts do not reference inter-condition discrepancies in corporate law when they deliver market place investigation on corporate valuations.

- Delaware courts have not referenced a Delaware high quality in appraisal conditions, suggesting that monetary pro witnesses are not contemplating Delaware law as a aspect of worth as nicely.

- Trade publications and standard finance textbooks do not condition that Delaware legislation is a element of value.

The dominant orthodoxy in corporate legislation scholarship accepts the relevance of the directionality discussion and the narrative of Delaware’s superiority. The admirers and advocates of Delaware regulation are numerous, and lecturers and elite corporate lawyers share a broad determination to the Delaware brand name and think that corporate organization at the countrywide degree is finest served by Delaware law. The notion of Delaware’s irrelevance is challenging. The theoretical arguments have currently been experienced. The most helpful critique would answer pointed inquiries of an empirical character.

If a person believes in Delaware’s effectiveness and the relevance of inter-point out distinctions in corporate regulation as calculated by efficiency, just one ought to be ready to answer basic but perplexing concerns. If the market place has not priced in “better” law, why not? Why hasn’t the sensible cash figured out a Delaware trade? What is the specific arbitrage trade from mispriced Delaware firms? If the market place has priced in improved legislation, what is the specific quantum of quality? How substantially untapped price can non-Delaware companies, including a person-3rd of the Fortune 500 businesses, notice from a improve in legislation? Why is a systemic high quality not commonly clear upon application of conventional valuation procedures even with scholarly endeavours dating again many many years? If these a systemic high quality exists, why do non-Delaware firms exist?

In quick, the pounds of empirical proof and market logic exhibits that Delaware legislation is irrelevant to efficiency. The load is on Delaware advocates to response the earlier mentioned issues.